Traditional language around money just didn’t fit.

Though I’m repelled by self-help stuff in general and financial advice in specific, I love the “Wild Money” books.

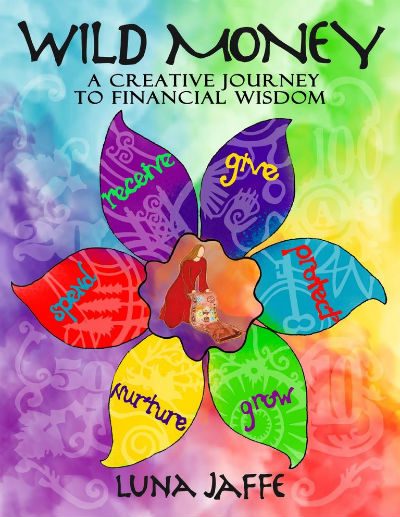

The neo-hippie, purple-red-green covers drew me inside, where I found brilliant design and compelling ideas. For example, in the explanation of stocks and bonds, a vivid drawing shows a dairy farmer handing some interest (a bottle of milk) to a bondholder, while the stockholder is enjoying dividends (a piece of cheese, with some red wine). Yes, it illustrates the concepts, but what impressed me most is that the farmer, in overalls, the shareholder, in a home office, and the bond holder, proffering bills, are all women.

For the past month, some friends and I have been getting together weekly to do Wild Money work.

We talk, write, eat and drink, draw, read aloud, and talk more about our financial pasts and futures. Already I’ve seen where my money-mojo is working (I’m not bad at “nurturing” what I’ve got, and “giving” goes well too) and where I want to expand (“growing” money).

The creator of the Wild Money movement is Luna Jaffe, a long-lived-lesbian of 55, who lives with her partner in Portland, Oregon. She has a BA in bilingual education, a master’s in depth psychology, and a background as a certified financial planner (CFP) and – surprise! – an artist.

Her books are Wild Money: A creative journey to financial wisdom and Wild Money: A financial field guide and journal (May 2013).

Why did you write these books?

This book developed because I had been working as a financial advisor for seven years, and not only were there no tools to help me be a financial advisor that worked for my brain, but there were none for the clients I wanted to work with, the [creative people] and especially women, people who are liberal-leaning and alternatively minded. The traditional world and language around money just felt boring. It just didn’t fit!

I wanted to teach people actual skills. You can’t just do the emotional work. What do you do about spending? What does investing mean? What do you actually own?

I don’t want people to lump all their experience of money into one definition, like “I’m good at it or I’m bad at it.” There are many different pieces to the money story. Some of us are great at receiving money and some are great at saving money, and some are amazing investors, but they suck at protecting the people they love. So I broke it down into sections, to get people to focus on discovering the places where they are strong and the places where they’re not. Those places might not be what they think they are.