Now you’ve made the ultimate decision about love, how about your money?

It’s been over a year since the U.S. Supreme Court legalized marriage for same-sex couples in all 50 states. For the lesbian, gay, bisexual, and transgender (LGBT) community, this is a joyful milestone. It is also a reminder that marriage is a big step with financial implications for any couple, and an opportunity for advisors to learn how the new landscape might affect LGBT clients. In a new Wells Fargo study, we set out to learn how LGBT Americans are adapting to the ruling and how it affects their outlook on finances—and life.

As a Financial Advisor for Wells Fargo Advisors, and as a member of the LGBT Initiative Committee, I was especially curious to see whether the research reflected the real-life experience of the LGBT clients I work with every day. The study showed us that while most LGBT Americans have been learning more about the rights and benefits of marriage over the past year, fewer than half have a full understanding of how marriage affects finances. This certainly resonated with me. I’ve had couples that are thinking about marriage come into my office to ask whether getting married is the right financial decision for them. In my 25 years as a financial advisor, I’ve never had an opposite-sex couple ask me that question.

.jpg)

Of those who are already married, many continue to hold assets separately with substantial numbers not making needed adjustments to important legal or estate planning documents. Wells Fargo’s study revealed that on average, same-sex married couples have been together for 12 years before “tying the knot.” Given the length of their pre-marital relationships, decisions about money and asset ownership are commonly made long before marriage.

When I meet with newly married LGBT clients, I find it surprising that many have not made necessary adjustments to important financial instruments. This is reflected in the study, which found that 29 percent have failed to review or change their beneficiaries, 37 percent lack medical directives, and 33 percent haven’t adjusted their will.

When I meet with newly married LGBT clients, I find it surprising that many have not made necessary adjustments to important financial instruments. This is reflected in the study, which found that 29 percent have failed to review or change their beneficiaries, 37 percent lack medical directives, and 33 percent haven’t adjusted their will.

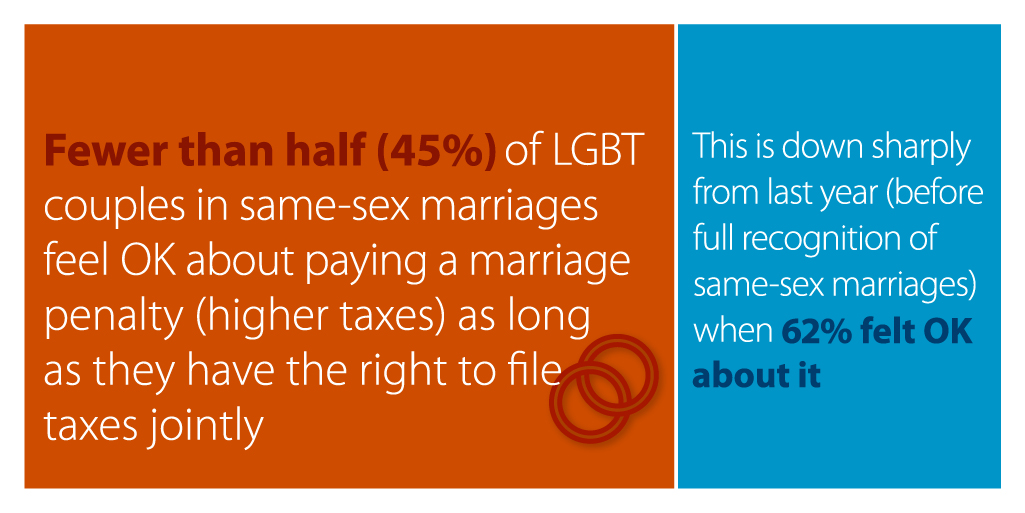

Tax filing is another important financial aspect of marriage same-sex couples need to take into consideration. More than three out of four couples in the study reported filing taxes jointly, yet fewer than half were okay with paying a marriage penalty (higher taxes) for this privilege. Many of my clients have been unpleasantly surprised by the substantial tax burden that marriage can entail. A marriage penalty is when a married couple has to pay more federal income taxes than two unmarried taxpayers filing separately. This penalty impacts married couples from every tax bracket but most affected are the couples with similar incomes.

-e1619579752913.jpg) The study also found that almost one in five Americans in same-sex marriages are planning to have children (including 47 percent of married millennials), although finances remain a concern. In many ways, the financial considerations for same-sex couples looking to have children are similar to those of heterosexual couples – the cost of the child’s education and the cost of living. However, a very distinct aspect of family planning decisions, and one that is still not clear after marriage equality, is adoption and its associated costs. Legal experts advise that adoption is still necessary to protect a same-sex parent’s rights to children; simply being married is not enough.

The study also found that almost one in five Americans in same-sex marriages are planning to have children (including 47 percent of married millennials), although finances remain a concern. In many ways, the financial considerations for same-sex couples looking to have children are similar to those of heterosexual couples – the cost of the child’s education and the cost of living. However, a very distinct aspect of family planning decisions, and one that is still not clear after marriage equality, is adoption and its associated costs. Legal experts advise that adoption is still necessary to protect a same-sex parent’s rights to children; simply being married is not enough.

-e1619579821811.jpg) While two-thirds of study participants feel marriage makes them more confident in planning for their future, my experience with clients backs up the data showing that more education is needed. When seeking counsel, I still recommend a financial expert who has the Accredited Domestic Partnership Advisor (ADPA) designation. The ADPA program was created jointly by Wells Fargo Advisors and the College for Financial Planning to educate financial advisors about the unique financial needs and considerations of domestic partners. They have been trained and certified on key issues affecting same-sex couples and recognize the importance of getting the financial part right in order to achieve your life goals together.

While two-thirds of study participants feel marriage makes them more confident in planning for their future, my experience with clients backs up the data showing that more education is needed. When seeking counsel, I still recommend a financial expert who has the Accredited Domestic Partnership Advisor (ADPA) designation. The ADPA program was created jointly by Wells Fargo Advisors and the College for Financial Planning to educate financial advisors about the unique financial needs and considerations of domestic partners. They have been trained and certified on key issues affecting same-sex couples and recognize the importance of getting the financial part right in order to achieve your life goals together.

Even with the complicated new landscape, the future seems bright for couples considering marriage. In the study, over 90 percent of recently-married same-sex couples report marrying the “love of their life” and half are still “pinching themselves,” not quite believing marriage is a reality for them. I have actually seen this joy reflected in newlywed clients as we work together on a long-term plan for their financial future, now as a happily—and legally—married couple.